How first home loan deposit scheme placements will affect the market

/Republished from Michael Matusik.

Whilst most of the housing industry applauds another 10,000 new federal government first home loan deposit scheme placements, some of us continue to shake our heads.

How did come to this, when it seems okay to place the top loan threshold for a first home buyer at $950,000!

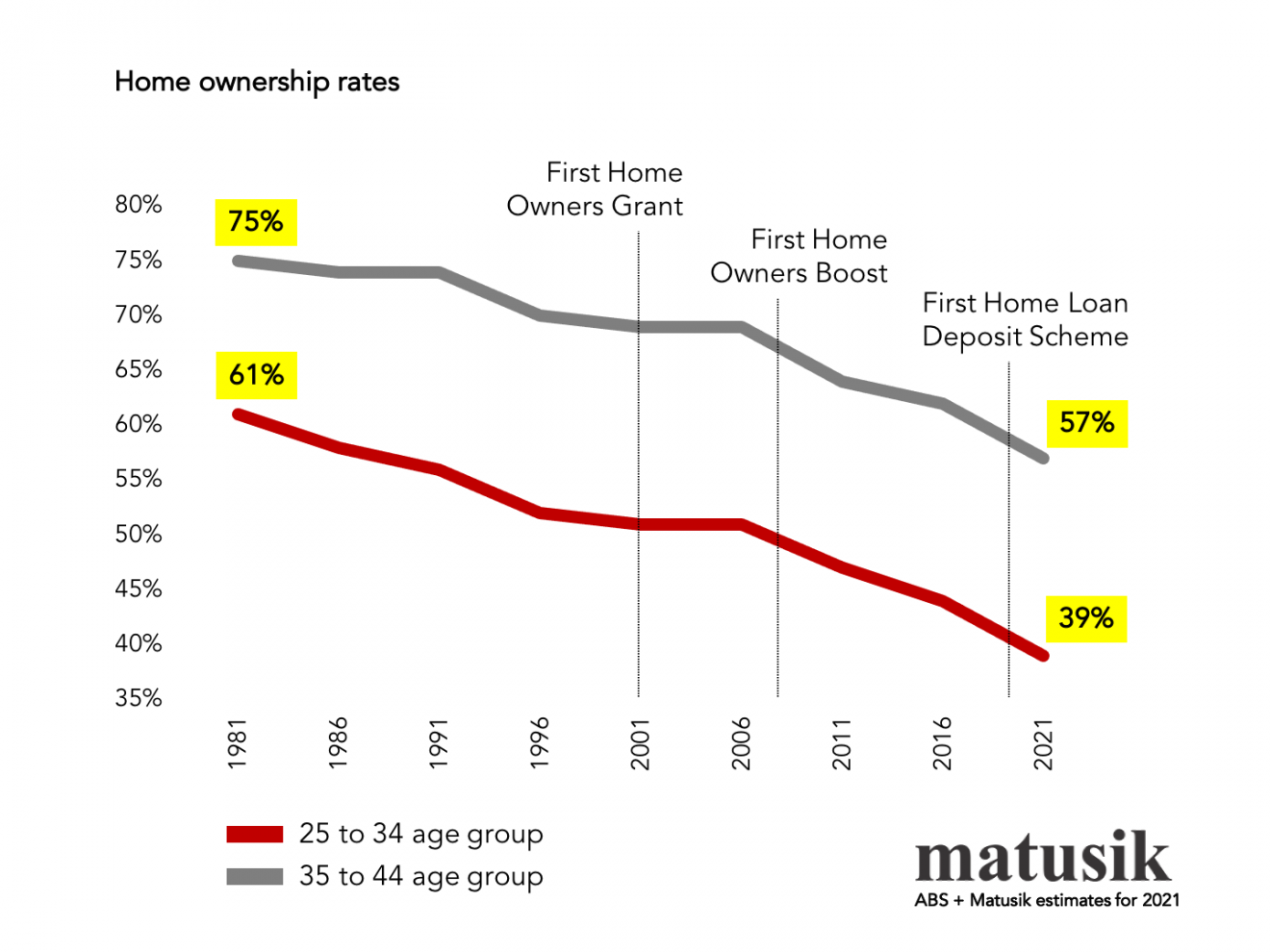

As my chart shows there are less first home buyers per relevant demographic cohort these days despite all of the first home buyer handouts.

Good politics. Crappy policy.

The recent $25,000 Home Builder scheme has also hurt as many new builds, and with that, construction-related businesses as it has assisted.

Pity if you didn't qualify for Home Builder. Most of your potential buyers have lost interest in your project. Many buyers, right now, are simply chasing the $25,000. The trail of damage here will be wide.

Yet it will most likely to extended and maybe several times. The new housing industry is now like a junkie. It needs a sugar hit. It lobbies to get it and at higher dosages each time.

Covid-19 was a missed chance to make some serious structural changes in this space plus a chance to send new builds to rehab.

Yes it would have been a shakier six months but home building in Australia would have come out stronger for it.

This article has been republished from Michael Matusik. Read the original article here.