Australia’s New Endangered Species: The First Home Buyer

/Housing Affordability

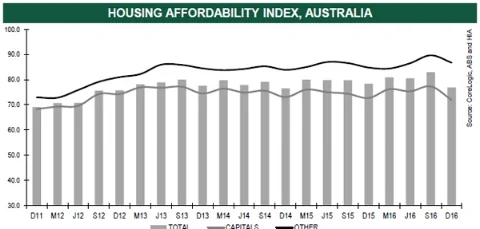

The recent Demographia International Housing Affordability Survey rate Australia as the 3rd least affordable market in the world and Sydney as the 2nd most unaffordable city. Yet the Housing Industry Australia Affordability Index shows gradual improvement in affordability over the past 5 years. So what really is going on?

Source: Corelogic, ABS and HIA

Historically the HIA Index may have been a useful measure but it now clearly has serious shortcomings. It is based on only 3 parameters: house prices, incomes and interest rates. Essentially the HIA considers that property is affordable if loan repayments are less than 30% of family income.

The problem is that the HIA methodology does not take into account several other important factors enabling the purchase of a property; eg

- Who is buying property

- The growing deposit gap

Over the past 5 years in particular there has been a strong shift in the proportion of property buyers who are first home buyers – down from its historical levels of around 18% of the total market to only 13.2% in the September quarter of 2016. In my own experience I have not helped a single first home buyer in the past 2 years who did not receive significant financial support from their family.

The Deposit Gap

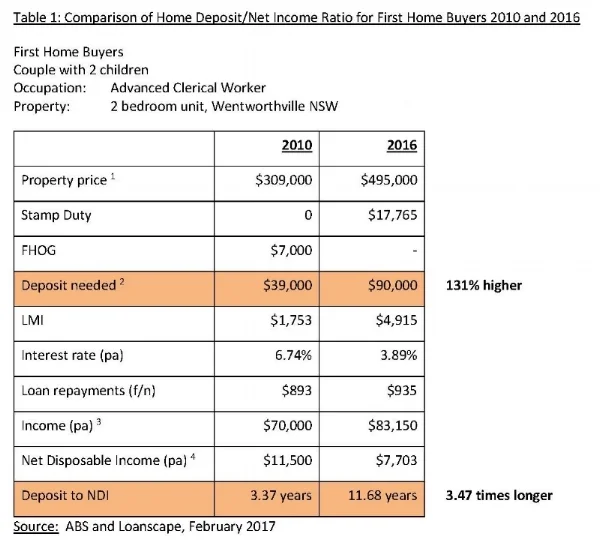

To demonstrate the scale of what first home buyers must now overcome I have prepared a real-life comparison to show how much the situation has changed in the past 6 years. In 2010 I helped a couple purchase a 2 bedroom apartment at Wentworthville in western Sydney for $309,000. They had saved a deposit of $39,000 or 12.5% of the purchase price. They had to take out a relatively modest home loan of $267,000 to complete their purchase. Table 1 shows how much more difficult that same purchase would be for the same couple today.

Today that same family, on the same relative income would have to pay $495,000 to purchase the same apartment. While there has only been a modest increase in the required loan repayment, the savings deposit now required to complete the purchase at the same level of risk has risen from $39,000 in 2010 to $90,000 in 2016. In 2010 it would have taken them a minimum 3.5 years to save the required deposit. Today it would take them nearly 12 years!

It is little wonder that so many young people have given up on the prospect of ever owning their own home. And they must find it really offensive when they are accused of frittering away their savings buying avocado on toast should they dare to venture outside their rented home on an outing!

Finding a solution to the overall housing affordability problem is complex and in many ways the opportunity for governments to make a real impact probably passed more than 2 years ago. But we need to do much more to correct the distortions in the market which work against first home buyers.

Notes

- 2010 figure is actual purchase price. 2016 estimate based on Residex Comparative Market Analysis for the same property in December 2016.

- Deposit needed is the amount of borrowers’ own savings required to complete the purchase transaction.Both scenarios are based on a discount basic home loan at 86% LVR. Borrowing at higher LVRs may be possible and this would reduce the amount of funds required to complete a property purchase transaction.

- Income in 2010 is actual.2016 income calculated using ABS data for growth in wages, 2010-2016.

- Net disposable income calculated by deducting average living expenses for a family of 4 living in modest rented accommodation from family net taxable income. Growth in CPI published by ABS used to calculate estimate for 2016 expenses.