Is buying off the plan still a good idea?

/Republished from ANZ Grow Magazine

Does the pending apartment glut make buying off the plan a risky investment? Gayle Bryant reports.

One way to purchase property is to buy off the plan. This is where a buyer enters into a contract to buy a property before it’s completed – usually as part of a multi-unit development. And while there are benefits to this, there are also risks.

One of the key attractions is the potential to secure a property at a discounted price. This is because you’re paying the current market value for a property that may increase in value by the time it’s completed. You generally secure the property for a 10 per cent deposit, paying the balance when the property is completed. This could be up to two years later, giving plenty of time to organise finances.

But with reports of a looming oversupply of units coming onto the market, particularly in the capital cities of eastern states, is now a good time to buy off the plan?

BIS Shrapnel associate director Kim Hawtrey says the glut is certainly something to be aware of.

“I think there is already an oversupply of apartments in the Melbourne and Brisbane CBD [central business district] areas and in certain pockets of Sydney,” he says. “In some cases developers are now offering incentives to ensure their projects are sold.”

Pros

Potential capital growth: if the value of your unit has grown in the time between paying your deposit and settling, then that’s growth you’ve benefited from without having had to pay interest on a loan.

Time to organise finances: usually, only a 10 per cent deposit is required to purchase off the plan, allowing time to organise finances before completion.

Grants: some states provide incentives for new homes, especially if you’re a first home buyer.

Cons

Risk of paying above market value: especially if there is an oversupply of units coming onto the market.

You don’t always get what you thought you paid for: not seeing a finished product means you’ll never be exactly sure what you’re buying.

Change in financial circumstances: a lot can happen between paying your deposit and the time to settle, such as a divorce, redundancy or major illness that could affect your ability to pay.

Interest rates may rise: as it can take some years for properties to be completed, rates may rise and this could affect your ability to finance your loan.

Developer may go bust: this isn’t unheard of, so due diligence is critical.

When it’s time to settle

Hawtrey says settlement risk is becoming more of an issue with buying off the plan.

“This occurs when a buyer has paid their deposit but in 18 months’ time, when they go back to the bank for a loan, they find the rules have tightened.”

For example, they may find they can’t borrow as much as they thought because of stricter lending criteria so may need to provide more of their own equity towards the purchase.

Furthermore, if the developer gets into dire financial trouble, there’s also a chance your property will never be completed, meaning you’ll lose your deposit and other upfront payments such as legal costs.

Marion Mays, founder of property investing mentoring firm Thalia Stanley, says the majority of her clients have had a positive experience buying off the plan

“[Some] people buy off the plan because they want to get in on a development early, or because of the stamp duty concessions,” she says.

These concessions vary by state. For example, in Victoria, there’s no stamp duty for new properties purchased off the plan while in New South Wales first home buyers are exempt from stamp duty on new homes up to $550,000 and are eligible for concessions on new homes up to $650,000.

However, May has also seen cases of buyers who have been unable to complete the purchase.

“In one case a developer approached me saying they had sold a unit off the plan for $700,000 but the couple were getting a divorce and couldn’t settle and so lost their deposit,” she says. “The developer said if I could on-sell the unit in the next 30 days the new purchasers could have it for $630,000. I was able to sell it to my clients for under the contract price.”

Because the value had gone up, it was also under market value, but they did have to pay stamp duty.

She adds while she has had clients who have bought off the plan and sold for a profit before settling, this isn’t a common strategy.

“My top tip for success is to do your due diligence,” says Mays. “This is crucial when buying off the plan as you are buying a promise that you will get what you’ve signed up for.”

ANZ Banking Group economist Daniel Gradwell concurs, and adds that if someone were interested in buying off the plan, they should consider buying something that differentiates itself from all the others coming online. He adds that a lot of the current house-price growth has been in houses rather than units.

“It’s a bit easier to add to the supply of units and we’ve seen plenty under construction or completed across the major capital cities,” says Gradwell. “A lot of this reflects buyers going into off-the-plan developments because they are generally more affordable than detached houses.”

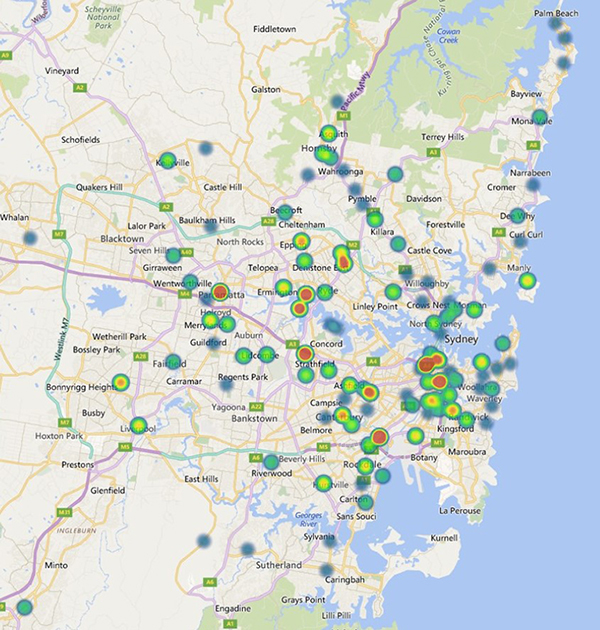

Heat maps of construction activity

According to the RLB Crane Index (Q3), which rates the intensity of construction every six months, in October 2016 there were 663 cranes erected across Australian capital cities. The vast majority (81.3 per cent) were on residential projects, compared to 5.3 per cent for commercial. Some 335 new tower cranes were erected across Australia’s skylines in the six months since the last report was released in March 2016.

Sydney

Construction activity is most buoyant in Sydney with 305 active cranes, 258 in the residential space*. Source: RLB Crane Index® (Q3) October 2016.

Melbourne

Melbourne followed Sydney’s crane count with 128 cranes. They are followed by Brisbane (95), Perth (48), Gold Coast (34), Canberra (24), Adelaide (15), Newcastle (9), and Darwin (1). Hobart (4 cranes) has been included for the first time*. Source: RLB Crane Index® (Q3), released October 2016.

(*Note: The size of the hotspots is relative to the scale of the map and is not an indication of the crane count in that position. Blue indicates a lower crane activity and brighter red represents higher crane activity.)

Negotiate before paying a deposit

Loanscape principal Bruce Carr agrees there are risks with buying off the plan, but this doesn’t mean it should be avoided.

“Lenders will generally only provide a formal loan approval once the development is completed, so after you pay your deposit you need to wait until it’s nearly finished before applying for a loan. You need to be confident your financial circumstances and lending criteria will remain sufficiently stable so that you qualify then.”

He adds that in most cases you don’t have much leverage after it’s been built, so it may be appropriate to negotiate upfront.

“Many people don’t realise they can negotiate contract terms and conditions before they pay their deposit,” he says. “If there are items in the contract you don’t like, you may be able to get them written out at this stage.”

One of the risks that concern buyers is that even if the value of the property has fallen by the time it’s completed, they still need to pay the original price. “If you agreed to pay $1 million for a unit that is only worth $800,000 when it’s finished, you are still liable to pay the $1 million,” Carr says.

“When you’re buying off the plan you’re participating in market risk – you just don’t know what proportion that risk is. Lenders determine the lending ratio using the market value at completion, so you should ideally have a strong equity position at the outset.”

Gayle Bryant has been a financial and business journalist and sub-editor for almost 30 years. She has written for a wide range of newspapers, magazines, custom and trade press and websites. Gayle’s articles regularly appear in the Sydney Morning Herald’s small business section and the Australian Financial Review’s special reports section.