According to Residex, the Australian property market has seen subdued growth in the September quarter.

The beginning of 2016 brought optimism for the global economy, with the possibility of US rate rises by December leading a potential pick up in the momentum of economic growth. Instead, the shock rise of populist leaders, a spreading sentiment of anti-globalisation and an increasingly precarious employment situation has seen falling confidence in government bonds and share markets.

In Australia, a two-speed economy persists. On much of the east coast, cities with an advantage in tourism and services are experiencing steady dwelling market growth. Concerns of over-supply in units may threaten the steadiness of certain Melbourne and Brisbane markets, while in Sydney, high unaffordability has seen a rise in the popularity of rural NSW markets. The resource states continue to face tough growth conditions.

September 2016 Median Value Index

SOURCE: RESIDEX

The above graph plots annual growth rates for the median Australian house and unit values and suggests that the housing market peaked in 2014. Country NSW houses had the highest value growth in the year to September at 7.41% in capital gains. This figure was down on the previous year’s growth of 9.94%, suggesting that regional NSW is now following the downswing in the Sydney market.

The strongest surge in rents was in ACT units and Tasmanian houses, while resource market rents continued to decline. The overall subdued growth in rents is likely due to an increase in investor activity, which has potentially increased the stock of rental properties.

Australian Market Growth

Australian GDP growth was strong at 3.3% in the year to June, up from 3.1% in March. This growth figure was driven by a surge in public spending, offsetting a fall in gross fixed capital formation of 4.5%. It is difficult to summarise Australian economic performance due to the variance in performance across regions.

Nationally, the unemployment rate fell to 5.6% in September. Unemployment is currently at its lowest level since May 2013. Though the number of people employed has risen, the under-employment ratio (the portion of working Australians who want to work more, but their employers cannot offer more hours) is relatively high at 8.9%. There remains downward pressure on wage growth and inflation due to the increased proportion of casual and part-time work in the overall labour force.

Policy response to subdued employment growth and low inflation has been to loosen monetary policy, with the cash rate held at a historically low 1.5% in October. Low interest rates have put pressure on already over-heated dwelling markets. A number of commentators are arguing that structural change and fiscal policy are urgently needed to create more sustainable employment, and take pressure off monetary policy decisions.

NSW Market Growth

Value and Growth Rate of State Final Demand - NSW

SOURCE: RESIDEX

Since the mining boom ended in 2013, NSW has been seen as having the most robust economic growth of the states and territories. June quarter economic growth was relatively low at 0.6%.

Growth was driven by a rise in dwelling construction, household consumption (due to wealth effects) and government expenditure.

Growth in the Sydney dwelling market is winding down: Residex repeat sales data show the median Sydney dwelling grew 2.08% in the year to September, down from 20.74% the same time last year. As growth slows in the sector, it is expected that there will be a negative impact on employment in the finance, construction and real estate categories.

Regional NSW v Sydney

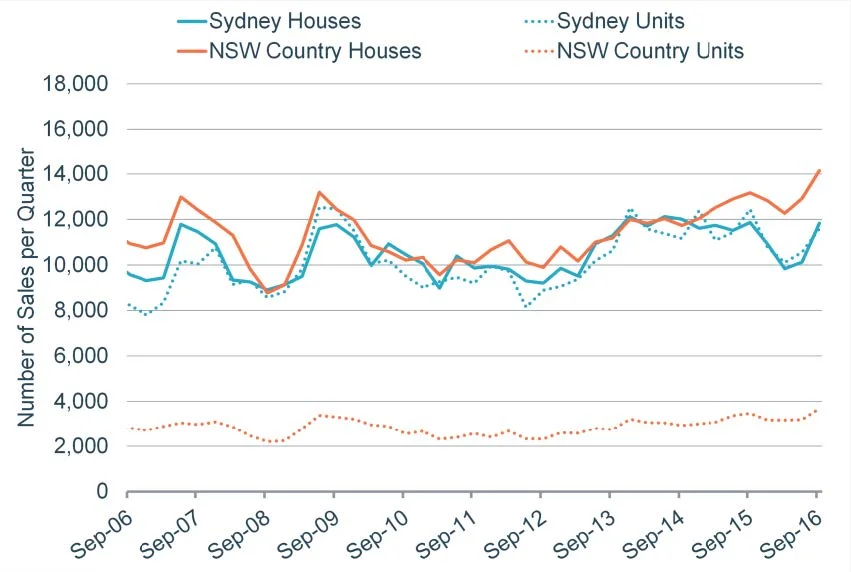

Quarterly Sales Volumes - Seasonally Adjusted

SOURCE: RESIDEX

Low interest rates have slowed the decline in dwelling growth, allowing more time for the economy to adjust. Sales experienced an uptick in the September quarter. The graph at left shows the seasonally adjusted Residex quarterly sales figures for Sydney houses and units, as well as Country NSW houses and units.

Among the top 20 sales volume areas were the postcode regions of Wagga Wagga, Tamworth, Orange, Bathurst and Dubbo. Country houses, rather than metropolitan units, outpaced sales growth of Sydney houses. Residex suggests that this could be due to affordability as the median metropolitan unit, at $705,500 is 57% higher than the median regional house in country NSW!

As the real estate boom winds down in Sydney and regional NSW, Residex expects the December quarter to show little to no growth in Sydney dwellings. As regional NSW follows the Sydney market at a lag, growth over the next few months may be lower than the September figure of 1.62%.