30,000 new housing grants released - do you benefit?

/On the 1st of July, the Australian Government made 10,000 new places available under the First Home Loan Deposit Scheme (FHLDS), the New Home Guarantee and the Family Home Guarantee, respectively.

This totals to 30,000 new scheme places released to support Australians buying a first home. Under the First Home Loan Deposit Scheme and the New Home Guarantee, you can purchase a property with a deposit of as little as 5% without paying lenders mortgage insurance (LMI), which would be typically required for deposits under 20%.

The newly announced Family Home Guarantee lowers the deposit required to 2% without paying LMI for single parents with dependent children, regardless of whether or not you’re a first home buyer.

This is because the federal government guarantees the remaining value of a 20% deposit to the participating lender. There are over 30 participating lenders through whom the scheme places are made available.

These spots are likely to be filled within a matter of months – so if you’re interested, it’s a good idea to reach out to our team. If you’re confused about whether you qualify, you can read the eligibility criteria below.

The First Home Loan Deposit Scheme

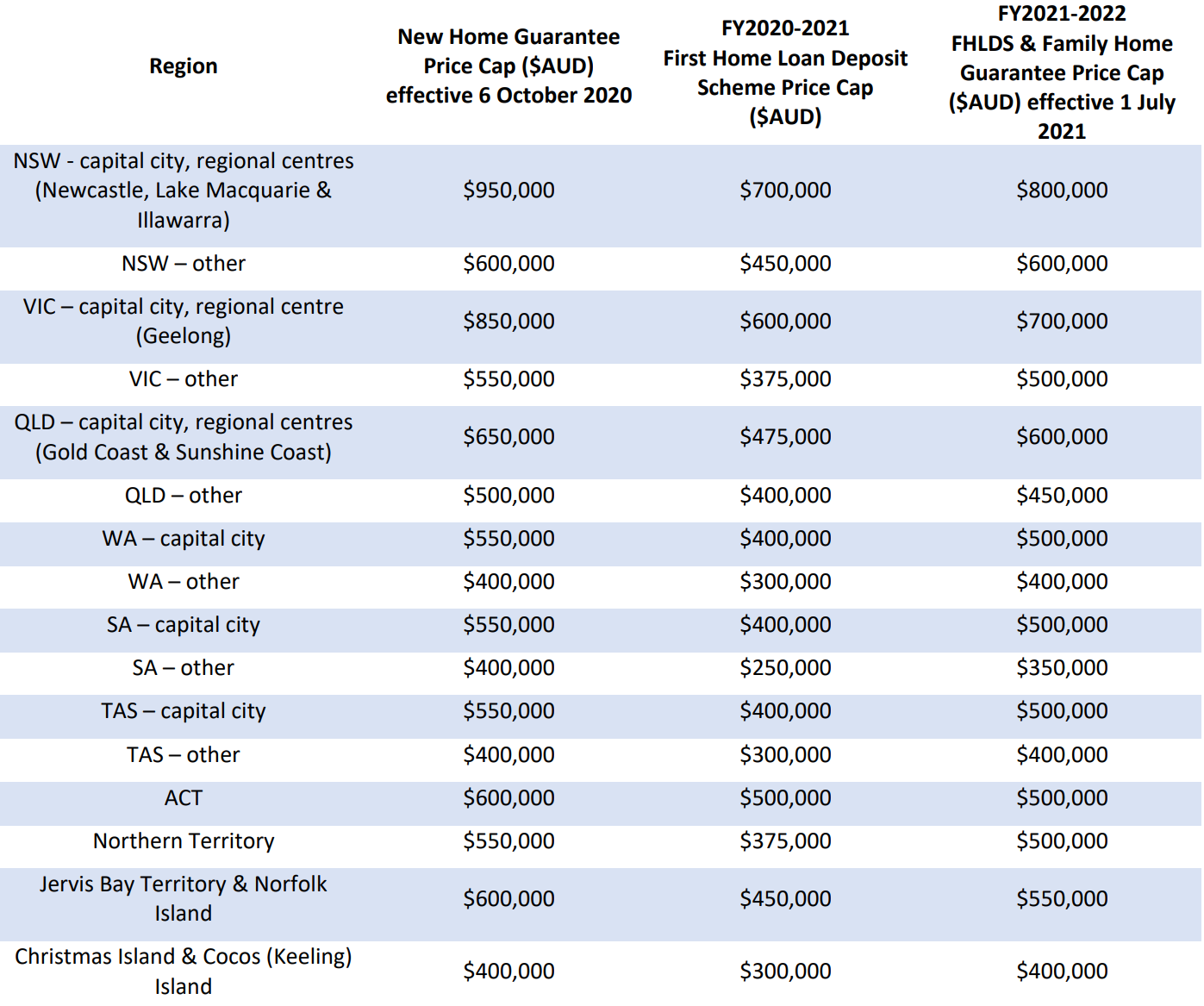

To be eligible for the First Home Loan Deposit Scheme, you must be a first home buyer purchasing a ‘residential property’ intended to be owner-occupied. There is also a property price cap detailed in the table below.

You must be an Australian citizen over 18 years of age, with a taxable income no higher than $125 000 (or $200,000 combined for a couple) in the 2020-2021 financial year. Couples are only eligible if they are in a de facto relationship or married. If you are purchasing a home with someone who does not have this relationship with you, you will not be eligible for the scheme.

You must have at least 5% and no more than 20% of the value of an eligible property saved. For more information, you can check the fact sheet.

The New Home Guarantee

The New Home Guarantee requires you to fulfil the same criteria under the First Home Loan Deposit Scheme, with additional requirements for the type of property eligible.

Under the New Home Guarantee, you must be building a new home or purchasing a new build - the property price caps are higher to account for the extra expense. There are also timeframes you must comply with – you can find out more here.

The Family Home Guarantee

Unlike the other schemes, you are not required to be a first home buyer to purchase a property under the Family Home Guarantee, but you must not currently own a home. Only single parents with at least one dependant are eligible, and you must not have a taxable income higher than $125,000.

This scheme allows single parents to secure a property with as little as 2% of the property value as a deposit without paying LMI. The same property price caps apply as those for the First Home Loan Deposit Scheme.

Property price caps

The table below outlines the different property price caps that apply depending on the scheme and property location. These price caps have increased for the current financial year as seen below.

How does this scheme help Australians?

While there are definitely benefits to this scheme, there are also pitfalls. These grants don’t address the root causes of housing affordability, but instead allow Australians who realistically would have entered the property market before enter sooner, targeting surface-level problems rather than structural issues.

But even for these Australians, the conditions of the FHLDS affects their ability to enter the market with reassurance. Sure, saving on the LMI allows Australians to avoid the sunk cost of rent and invest their money into an asset, but the requirement of having less than 20% of the deposit as genuine savings makes this venture into the property market riskier. It is typically recommended that first home buyers have savings to fall back on in case of an emergency and this limitation impacts that possibility.

Additionally, the property price caps are relatively low and affect the potential for applicants to buy a property they are sure will hold its value in the future. It limits their options for a smart property investment - again, making their purchase riskier.

That’s not to say that you should disregard this scheme entirely. For many people, this is a great stepping stone to becoming a property owner and can help you work towards a more financially stable future.

If you’re interested in finding out more, contact us at Loanscape today to get started on your loan application.