Sydney Market Gains Strongly in June Quarter

/Residex June Quarter Report

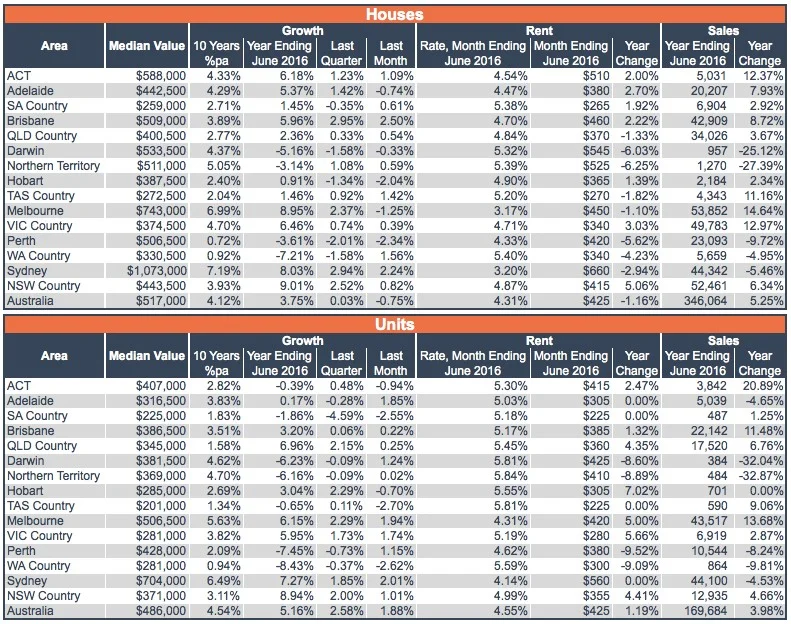

According to Residex, the Australian property market has generally performed well in the June quarter.

The Sydney , Melbourne and Brisbane markets experienced strong gains with the exception of home units in Brisbane, where the market is flat. WA and NT continue to decline.

Source: Residex

Across Australia the median price for units increased by 2.58% while the median house price remained flat. These figures fluctuate periodically, simply reflecting the fact that different markets move along in different cycles both regionally, and by dwelling type.

In Sydney the median house price moved by almost 3% mostly in the month of June. The winter market often sees relatively strong gains as supply is generally constrained - impatient buyers tend to push up the market. The annual growth rate is now down to 8% (it was nearly 22% in the year to October 2015).

Source: Residex

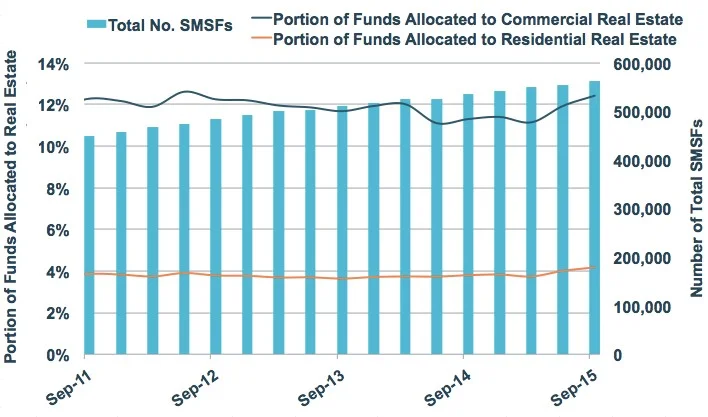

Residex makes an interesting comment on possible reasons for continuing strong demand. Their property commentator, Eliza Owen speculates that demand is now being fuelled by the increasing age demographic of property buyers and the flow of money from self-managed super funds (SMSFs) investing in the property market. This could explain the apparent tolerance of investors to ever decreasing real returns on property investment.

My own view is that this bubble has been pricked, firstly by the actions of APRA in leaning on the banks to curtail lending to investors, and secondly by the drawback from lending to SMSFs by most of the major banks. So we should see this flow of money moderate.

The Age Gap

But certainly property investing is increasingly the domain of an older demographic which can more easily tap into the equity in their homes or other property to leverage further investment. The imbalances are stark. If $1M homes increase in market value by 30% (which they have) then that enables the owner to access $240,000 in "saved" equity. A couple saving cash would need to be earning in excess of $500,000 per annum to match that rate of savings.

Some baby boomers are choosing to help their offspring into the market. I have heard it termed as "passing on their inheritance before they die". But this again is the domain of the relatively few that can afford to do it. And it is strategy not without risk with future expenses in health care, and entry costs into aged care anything but easy to determine.