Residex has just released its March quarterly report on the NSW and national property markets. The key points are:

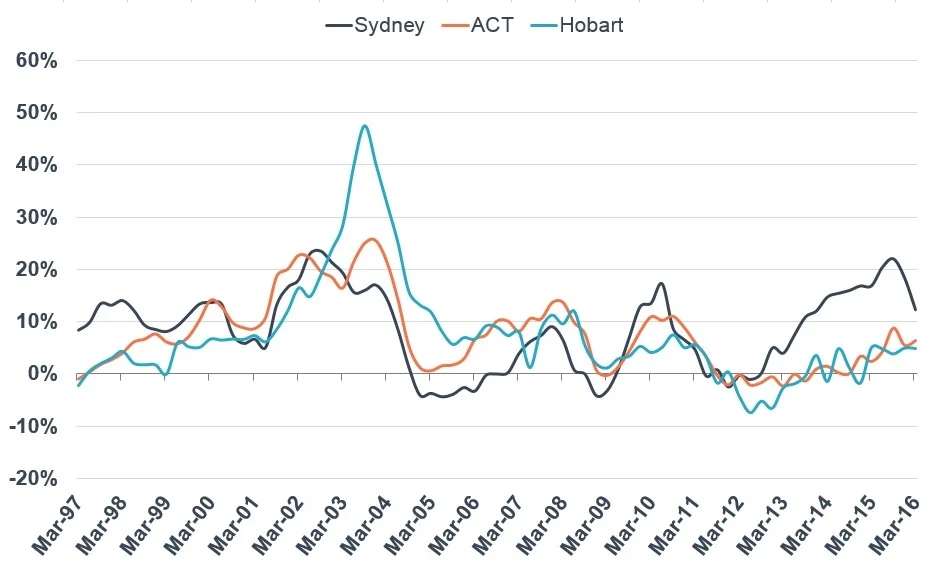

Annual growth rates - Sydney, ACT and Hobart houses Source: Residex

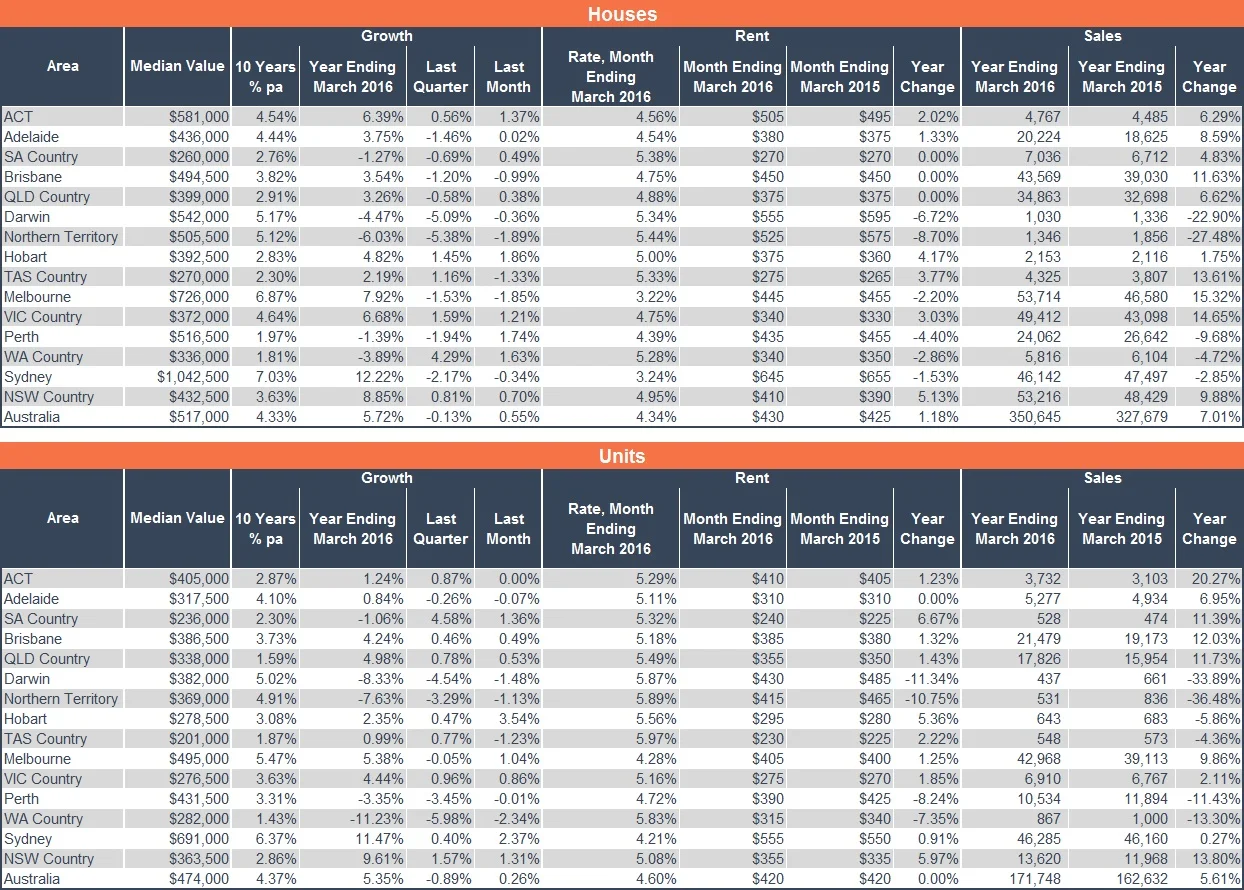

- The median value house across Australia peaked in November 2015. 17 of Australia's major dwelling markets contracted in the March quarter. The worst performing markets were Darwin (-5.09%) and Sydney (-2.17%).

- Nationally, the largest capital growths in house prices in the year to March were experienced in Hobart (4.82%) and the ACT (6.39%). This has been attributed to the lifting a public service hiring freeze in Canberra and the transition from mining to tourism benefiting Tasmania.

- Lower interest rates triggered stimulated speculative activity in housing markets causing prices to increase. For the first time ever, in 2014 more money was being lent to investors rather than owner occupiers. This eased shortly after APRA intervened last year to rein in investment lending. This will likely lead to house prices coming down as interest rates increase.

- Foreign investment - there are a lack of data, making it hard to gauge the impact of foreign investment in Australia's housing markets. However, their best guess is that this has increased rapidly between 2012 and 2015.

- The Australian economy remains fragile since the end of the mining investment boom. This has been exacerbated by the slowdown in China, stagnant wage growth, falling overseas migration growth and the deteriorating balance of trade. So far housing has escaped this impact but it is expected to flow through to housing over the next few quarters. The monthly inflation result showed that prices actually declined across the country by 0.2%.

- The Federal budget was in counterpoint to the views of the RBA and the IMF. The IMF believes that in uncertain ecenomic times governments need to be doing more to redistribute wealth and stimulate spending. The modest budget, with its tax cuts to small business and middle income earners does not address the need to stimulate and diversify growth in Australia.

- In the quarter to March the median NSW house price fell 2.17% while unit prices remained essentially steady. The bottom 25% value of houses in Sydney (in the range $480,000 to $715,000) were the last to peak.

- While it is clear that the market has entered the downswing phase of the cycle it is difficult to predict the medium term trend. NSW has a diverse strong economy but it is largely driven by construction right now. The unemployment rate is falling, population growth is trending upwards and dwelling approvals have plateaued. Will the decline in house prices lead to contraction in other sectors, or will the cut to interest rates stimulate further speculative investment and a possibly overheated market?

Source: Residex

If you would like a copy of the full Residex report please click here or contact our office.