Inside the Inner West property price boom

Over the course of this year we have witnessed an extraordinary boom in house prices across Australia. For existing home owners, this is good news as the asset beneath their feet has appreciated by as much as 16% in 12 months.

But if you’re a first home buyer or looking to upgrade, it presents an enormous financial — and sometimes emotional or logistical — challenge. Many prospective buyers are having to alter their plans for suburb or dwelling size or consider taking on larger home loans to purchase their dream home.

We’ve consolidated data from eight indicator suburbs of the Inner West council area to obtain a clear picture of the change that is flowing through the market.

Overall Trends in Sydney

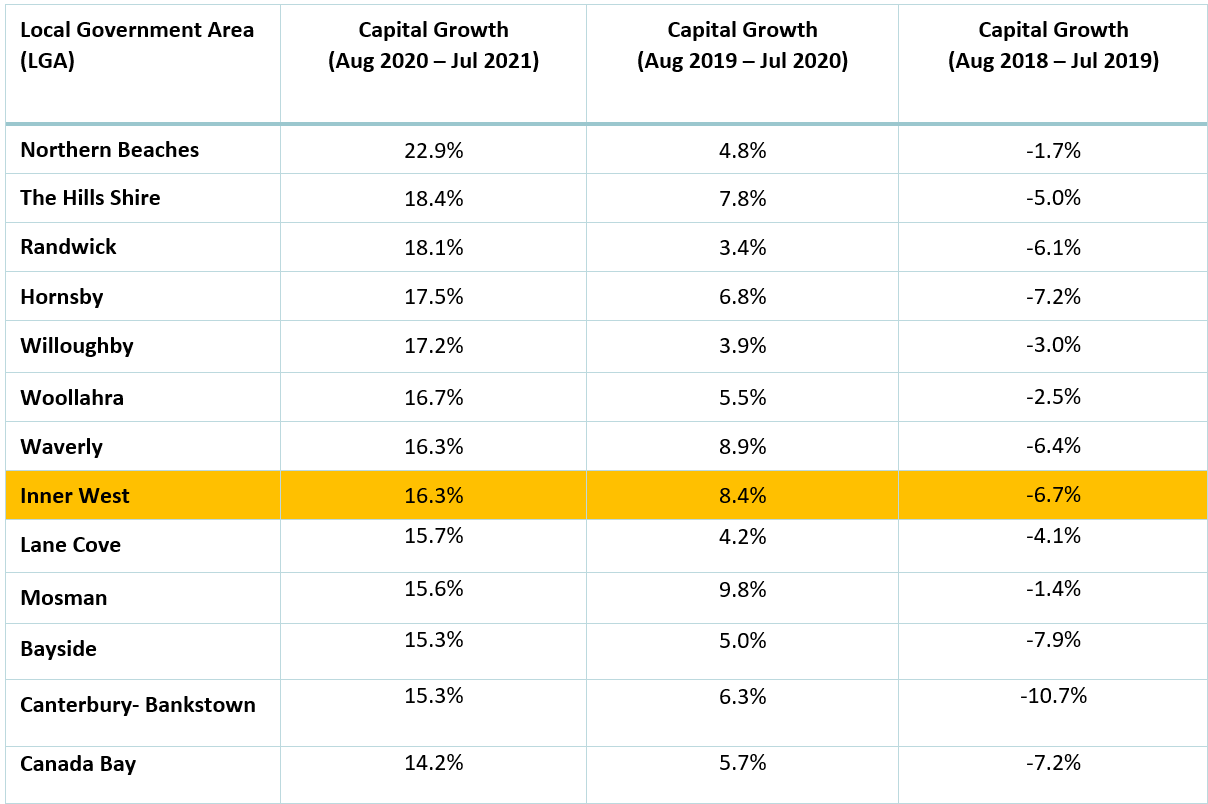

Table 1 shows how house price movements in the Inner West compare with other key LGAs in the Sydney basin. Like its peer regions in the inner ring, the Inner West maintains a relatively high median price and its capital growth is ranked eighth of all Sydney LGAs (CoreLogic Residex, 2021).

table 1: Key Sydney LGAs by capital growth (Source: CoreLogic Residex)

Inner West Trends - Houses

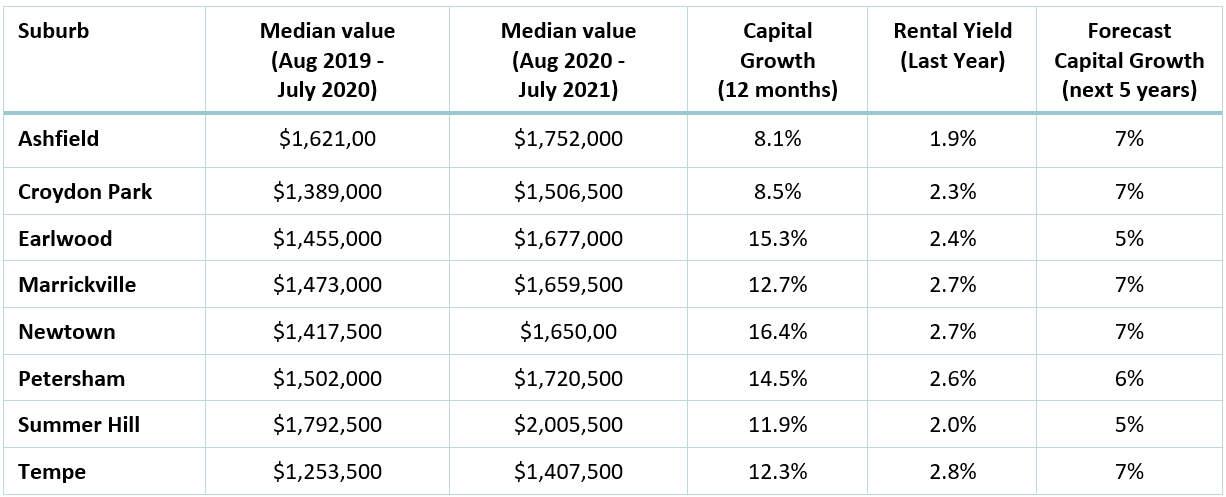

The median house price in many Inner West suburbs has increased by as much as 16% in the past 12 months, driven by low interest rates fuelling strong demand for a finite amount of housing stock in the area. We are also seeing rental yields fall as relatively light demand for rental properties result in rents remaining stable or even falling.

Lifestyle, convenience and tribal identification are key factors that influence interest in buying in the Inner West.

table 2: INNER WEST HOUSING TRENDS (SOURCE: CORELOGIC RESIDEX)

Inner West Trends - Units

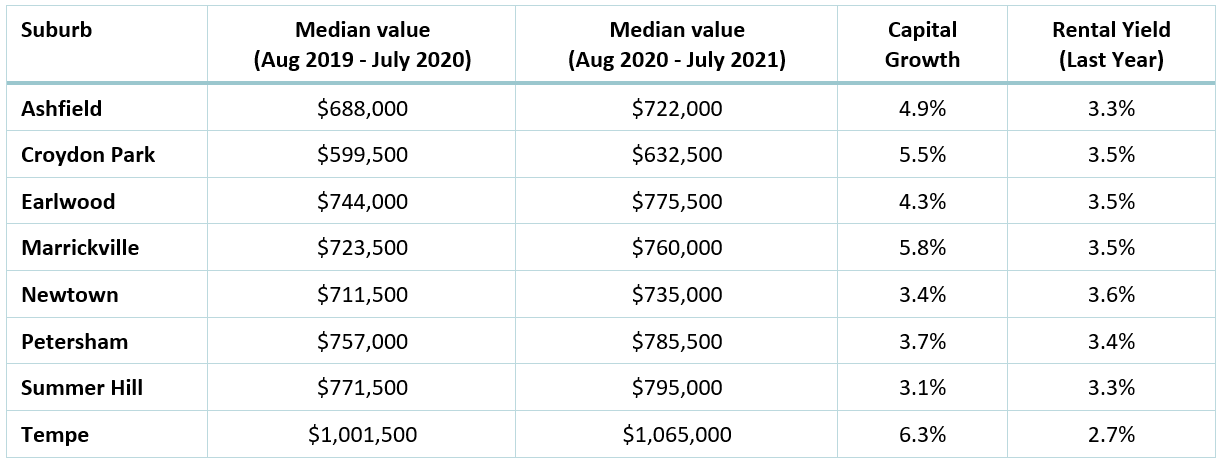

Table 3 shows that prices for units have risen much more modestly than houses. While demand remains strong, this has been matched by large unit developments in suburbs such as Summer Hill, Lewisham, Dulwich Hill and Canterbury. The quality may not always be there but there has certainly been quantity.

The relatively modest price increases in units present a challenge for those looking to upgrade from an apartment to their first house. The price gap is widening considerably and can only be bridged by increased borrowings or a move out of the area.

TABLE 3: INNER WEST UNIT TRENDS (SOURCE: CORELOGIC RESIDEX)

Lessons for Home Buyers

Prospective home buyers need to adapt to a fast-moving market. Your way will depend upon your financial and social circumstances, but here are some things to consider:

Act quickly – this is not a time for procrastination.

Don’t panic – concurrently, do not be bullied by the market into making a sub-optimal decision. Property transaction costs are too high for wrong decisions that result in needing to move again after 1 or 2 years.

Try to sell and buy in the same market – this is the best way to deal with market price risk

Reconsider your plan and priorities – if the market is not delivering what you want at the price you can afford, look for value in lower cost nearby areas or even further away

Take a long-term view – transaction costs remain high so time in the market is preferable to trying to time the market.

Keeping these tips in mind while considering your property options is key for making the right purchase decision, whether it be in the Inner West or another LGA.

References

Residex Marketfacts, 2021. Local Government Area Statistics Report: Suburban Sydney. CoreLogic.

Residex Marketfacts, 2021. Suburb Statistics Report: Ashfield, Croydon Park, Earlwood, Marrickville, Newtown, Petersham, Summer Hill, Tempe. CoreLogic.

Social sharing

Disclaimer: This article is intended to provide general news and information only. While every care has been taken to ensure the accuracy of the information it contains, neither Loanscape nor its employees can be held liable for any inaccuracies, errors or omission. All information is current as at publication release and the publisher takes no responsibility for any factors that may change thereafter. Readers are advised to contact their financial adviser, broker or accountant before making any investment decisions and should not rely on this article as a substitute for professional advice.

Loanscape has today released its Borrowing Capacity Index for Q4/2024. It confirms the forecast trend that borrowing capacities of Australian individuals and families are recovering from their low levels which coincided with the last of the recent increases to borrowing rates initiated by the Reserve Bank of Australia.