Market Essentials - May 2023

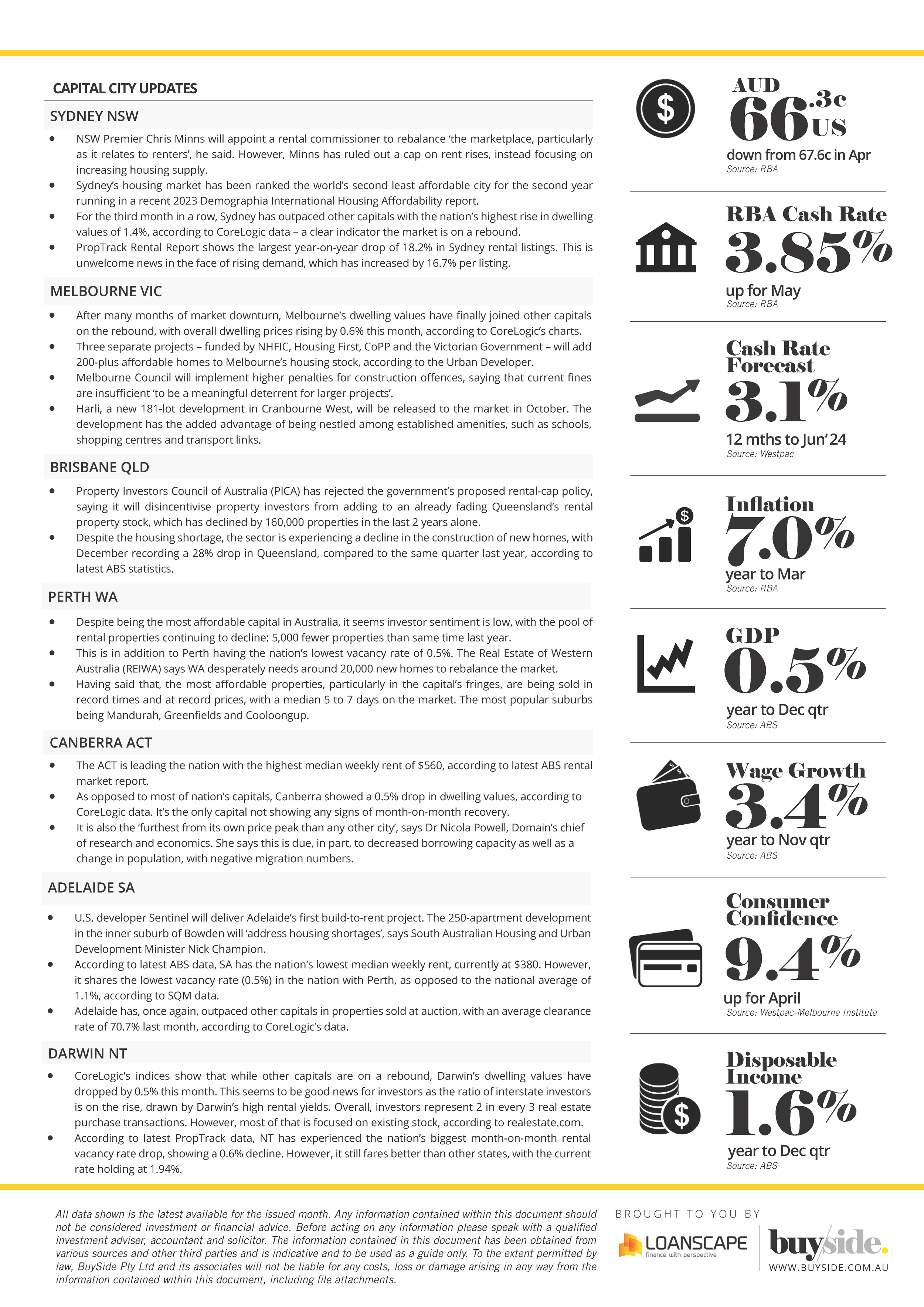

After a recent review, the RBA is set to undergo the biggest reform in decades, effective 1 July 2024, with the current board losing its powers to set the cash rate. According to Treasurer Jim Chalmers, the most significant change involves the creation of two boards, one for governance and one for monetary policy, with the latter having dual objectives: monetary stability and employment.

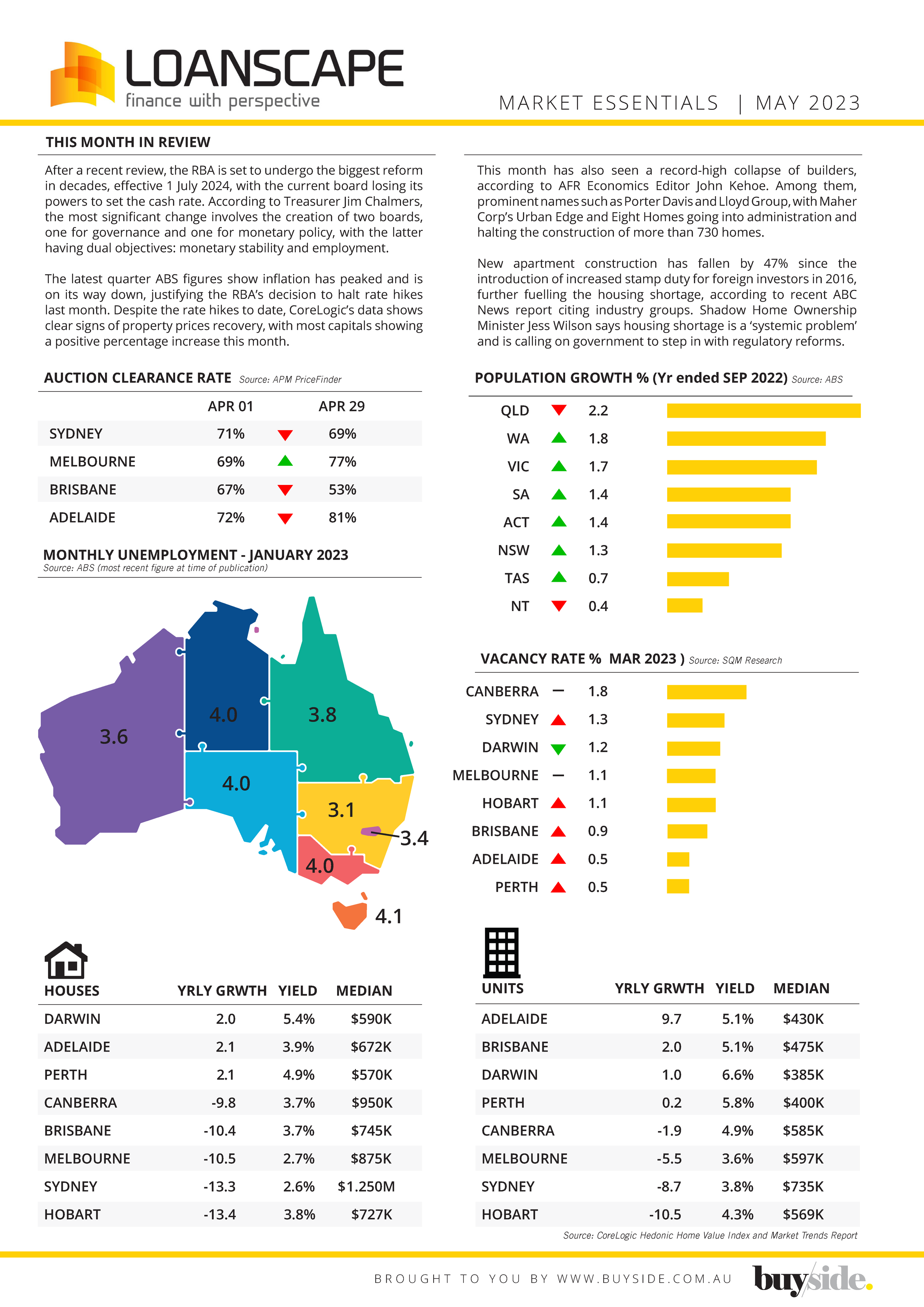

The latest quarter ABS figures show inflation has peaked and is on its way down, justifying the RBA’s decision to halt rate hikes last month. Despite the rate hikes to date, CoreLogic’s data shows clear signs of property prices recovery, with most capitals showing a positive percentage increase this month.